27 May, 2022

FX Options Guide - Section 11 - Knockout Option

Your Goals In This Section

The intention of this section is to give you the knowledge of Knockout Options that will enable you understand what they are, how they are used and what needs to be considered from a pricing perspective.

Your goals by the end of this section are to be able to:

- Detail what Knockout Options are

- Explain the characteristics of knockout options and how they differ from standard European options

- Compare the different types of knockout options

- Discuss what has to be considered when pricing a knockout option

- Gain a basic intuition as to how the price of a Knockout Option compares to that of the equivalent standard European option

Choose Your Path To Achieving The Section Goals

Setting you up to acheive the goals of this section is our goal. Having some knowledge of standard Eurpean options, if you are not yet familiar with them, would help you achieve the section goals.

- If you are already familiar with standard European options, then continue reading

- If not, and you want to cover this first the you will find the links to the relevant sections here...

Knockout Option Introduction

The knockout option is a type of fx option and was one of the first exotic options to become popular in the financial markets in general and the foreign exchange market in particular. As early as the late 1980’s it was used by Japanese traders who tended to sell knockout options in trending markets. Knockout options are perhaps the most intuitive of the barrier family due to their similarity to standard European fx options. Knockout options can also be referred to as knock out options or knock-out options.

Knockout Options Versus Standard European Options

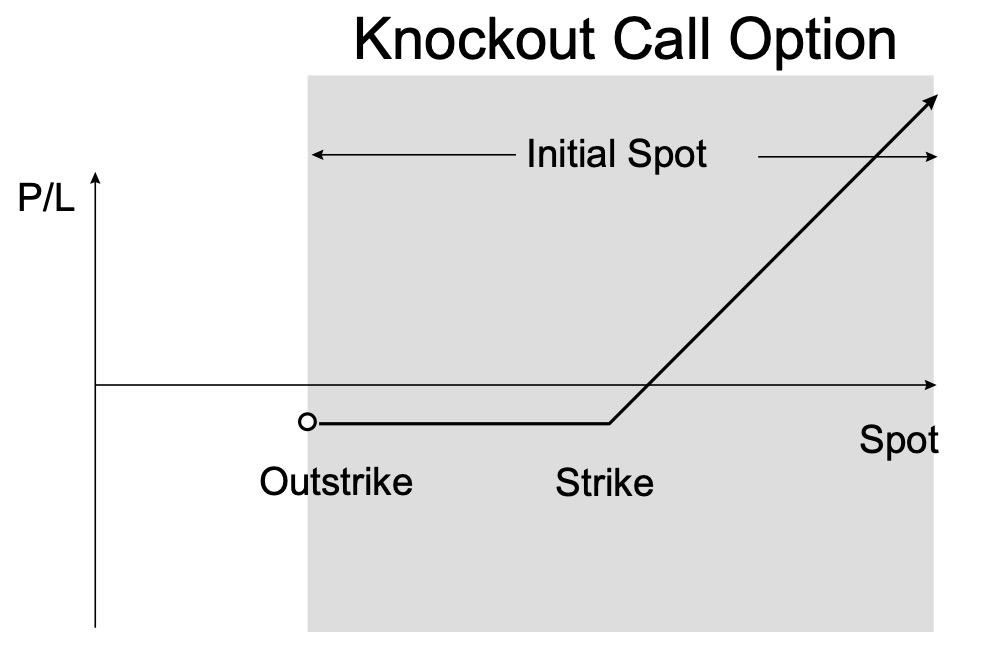

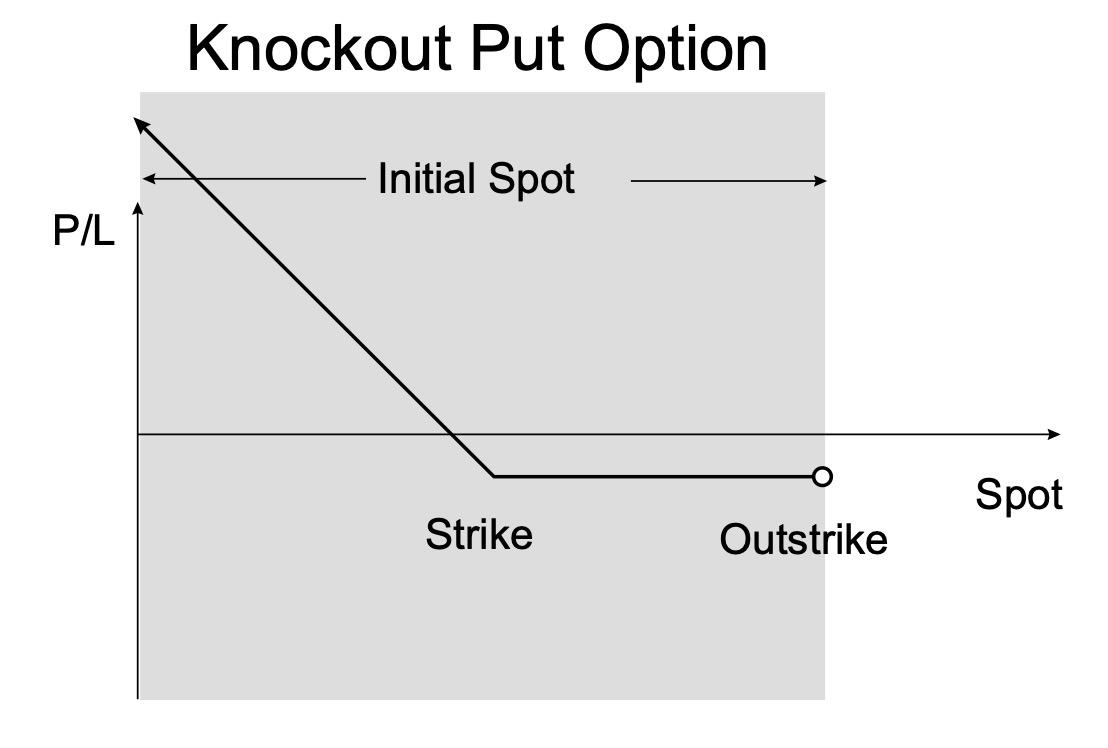

The knockout option differs from a standard fx option by the additional feature of an outstrike price. The outstrike price, also referred to as the knockout barrier (or knock-out barrier) is a predefined rate such that if spot trades at or beyond the outstrike price during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the option, then the option terminates. If the outstrike is never triggered then the pay-off from the knockout option at expiration is identical to that of the equivalent standard European option.

The Benefits Of Knockout Options

The key benefit of a knockout option is that it costs less than the equivalent standard European option. The amount by which a knockout option is cheaper than the equivalent standard European option is a function of the outstrike price in relation to where spot is trading at the time of pricing and the time to expiration. The closer that the outstrike is placed to spot the greater the discount that the knockout option trades at relative to the standard European option. All else being equal, the longer the time to expiration the greater the discount that the knockout option trades at relative to the standard European option.

The Key Feature Of Knockout Options

The feature that distinguishes a knockout option from other barrier options, such as a reverse knockout option, is the location of the outstrike relative to both spot and the options strike price. The outstrike price of a knockout option is set such that spot needs to move in the direction of Out-Of-The-Money with respect to the option for the outstrike to be triggered. That is, the option is falling in value when the outstrike price is triggered.

Types of Knockout Option

There are three types of knockout option:

- Regular Knockout

- Strikeout

- Parityout

Regular Knockout Option

The regular knockout option is by far the most common type of knockout option. It is characterised by the fact that the outstrike is chosen such that it is out-of-the-money with respect to the strike price.

Strikeout Option

The strikeout option is a special case of a knockout option where the outstrike is chosen such that it is the same as the strike price.

Parityout Option

The parityout is the most extreme of the knockout options. The parityout differs from other types of knockout in that the outstrike is chosen such that it is In-The-Money with respect to the strike price. Note that both the strike and outstrike are out-of-the-money with respect to spot.

How To Use Knockout Options

As the knockout option is so similar to a standard European option it can be used in place of a standard option in any strategy. However, the knockout option is used frequently in specific derivative trading strategies.

The Risks Of Knockout Options

The primary risk of a knockout option, if you are long the option, is that the outstrike is triggered and the knockout option terminates. For this reason, knockout options have a different sensitivity to market volatility. Whilst in a European standard option the price of the option increases as volatility increases for a knockout option the price sensitivity to volatility is reduced. As volatility increases the probability of large moves both increases the chance of expiring further in the money and increases the chance that the outstrike will be triggered and the option terminating.

From a trading risk management perspective, the option will be continuously delta hedged. If the barrier is triggered and the option knocks out the delta hedge will no longer be required. Trading desks therefore place spot orders in the market to unwind the delta hedge when the barrier is triggered.

Knockout Option – How It Is Used

The knockout option is widely used by market professionals in both hedging and trading strategies.

Knockout Option Hedging Strategies

- Buy a knockout option

The knockout option is ideally suited to hedging transactional exposures, and offers a lower cost alternative to a standard option. Adverse movements in the underlying are hedged by the knockout as they would be by a standard option providing that the outstrike is not triggered. For the outstrike to have been triggered spot would have to have moved favourably with respect to the underlying exposure, which would have appreciated in value. However, if the outstrike is triggered the exposure becomes unhedged, therefore, it is essential that the gains in the underlying are locked-in in some way. This could be achieved by placing an order at outstrike to replace the knockout option with either a forward or an option.

- Buy a knockout option spread

As an alternative to simply buying a knockout option, a call spread or a put spread can be bought where both the long and the short leg of the strategy have the same outstrike price. This strategy is cheaper alternative to simply buying a knockout option. It is particularly well suited to exposures of six months or greater. The strategy requires active management.

-

Risk Reversal with the long leg a knockout

-

Buy a knockout versus selling a strangle

Knockout Option Trading Strategies

- Buy a knockout option

Knockout options can be used to incorporate a technical analysis view into an options strategy. A knockout option is bought where the outstrike is placed just beyond a technical support or resistance level that is expected to hold, therefore effectively protecting the outstrike from being triggered. As the knockout trades at a discount to the equivalent standard European option it provides a lower cost alternative, therefore increasing the leverage that the trader can achieve.

- Sell a knockout option

The seller of a knockout option receives a premium. If the knockout option is knocked out then the seller keeps the premium, but no longer has a liability from the short option. Therefore, traders sell knockout options with outstrikes that they believe will be triggered. This is a particularly effective strategy in trending markets.

Knockout Option - Pricing Examples

Knockout Option - Pricing Example 1

Maturity: 3 month Call/Put: EUR call / USD put Strike: 1.1500 Outstrike 1.1150

Spot: 1.1441/45 USD per 1 EUR Swap: -0.00308/305 USD per 1 EUR ATM Volatility: 9.60/9.80

Price: 1.27% / 1.35% of EUR face

Equivalent standard European option: 1.56% / 1.62% of EUR face.

If spot trades at or below 1.1150 USD per 1 EUR prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or below 1.1150 prior to the expiration time on the expiration date the buyer of the option will buy EUR at 1.1500 if spot is at or above that level at expiration.

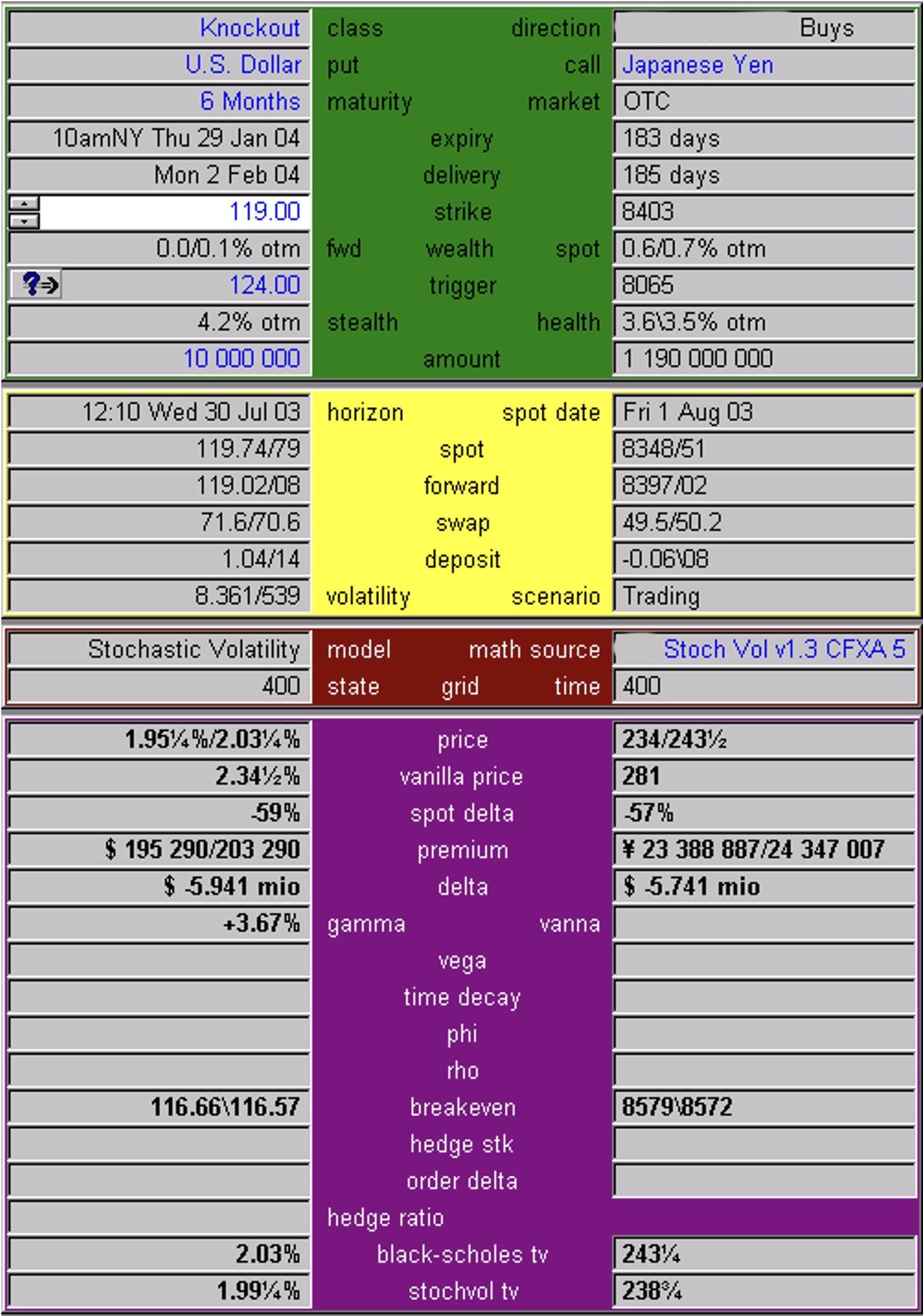

Knockout Option - Pricing Example 2

Maturity: 6 month Call/Put: USD put / JPY call Strike: 119.00 JPY per 1 USD Outstrike 124.00 JPY per 1 USD

Spot: 119.73/78 JPY per 1 USD Swap: -71.6/-70.6 JPY per 1 USD ATM Volatility: 8.35/8.55

Price: 1.955% / 2.035% of USD face

Equivalent standard European option: 2.31/2.385% of USD face.

If spot trades at or above 124 JPY per 1 USD prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or above 124 prior to the expiration time on the expiration date, then the buyer of the option will sell USD at 119 if spot is at or below that level at expiration.

Knockout Option – What To Consider When Pricing

- Large barrier delta - slippage risk

If the face amount of the option is large for that particular currency pair, and/or the barrier delta is large, then special consideration should be given to the potential for slippage risk if the knockout option is being sold. The barrier delta is the delta hedge amount for the option when spot is about to trigger the outstrike. The size of the barrier delta is significant because when the outstrike is triggered a spot order must be executed to close out the delta hedge associated with the knockout option, as once the outstrike is triggered the knockout ceases to exist and no longer requires the delta hedge. If the order at the outstrike is greater than can reasonably be executed at the outstrike level by a spot trader in typical market conditions then losses may be incurred when the order is filled. These potential losses have to be accounted for in the pricing of the knockout option. The best way to account for potential slippage losses is to price the knockout with an adjusted outstrike, where for the purposes of the initial pricing the barrier is moved to the level where the spot order at the barrier might reasonably be filled. This has the effect of making the knockout option more expensive. The amount by which it is more expensive is the amount by which potential future losses due to slippage in filling the order at the outstrike are compensated upfront. Slippage risk is greatest in those currencies that are least liquid. When taking into account at what level a spot loss order at the outstrike price may get filled, consideration should be given to the fact that the order could get filled in time zones where liquidity in the currency pair may reduced.

- Outstrikes placed at round number levels

When pricing a knockout option some consideration should be given to the level at which the outstrike is placed. If the outstrike is placed at a round number level, or a big figure level then it may increase the likelihood of being knocked out. The market has become accustomed to barrier levels that are at such levels and can target the orders associated with the barriers. As these levels can be congested by orders it can increase the risk of slippage (see above). Clients should be advised not to have outstrikes at round number levels.

- Boundary conditions

a). Value of equivalent knockin option When pricing a knockout option the value of the equivalent knockin option should be checked. If the value of the equivalent knockin option is very low then it may be necessary to lower the bid of the knockout option. Since buying a knockout option is synthetically equivalent to buying a European option and selling a knockin option it is important that the knockin option is not sold too cheaply.

b). Value of equivalent standard European option The offer price of a knockout option cannot be greater than the offer price for the equivalent standard European option.

- Probability of triggering the outstrike

The value of a knockout option is dependent on the probability of the outstrike being triggered. The probability of hitting the barrier should be checked by pricing up a One Touch digital with the same barrier level. If the probability is less than 10% or greater that 90% then special care should be taken in checking the boundary conditions described in 3 above.

- Parity at the barrier

If the knockout option is a parityout, i.e. if it has intrinsic value when the outstrike is triggered then the price should reflect the additional risk at the barrier. In particular the width of the bid ask price should be consistent in currency terms with the width of an equivalent One Touch digital with a coincident barrier. It should also be checked that the amount of parity is within any limits that are set for such discontinuous risk, allowing for the fact that there may be trades with similar risk in any existing portfolio of barrier options.

- Trading bands

Special care should be taken for currency pairs that are not freely floating. In particular, outstrike price levels should be avoided if they are outside any trading bands. Since levels outside the trading band are unlikely to be traded, the option no longer has the characteristics of a knockout option and should not trade at a discount to the equivalent European standard option.

- Term structure

Knockout options are sensitive to the term structure of interest rates and volatility. If the term structure of interest rates and / or volatility are steep, then an appropriate term structure model should be used to capture these effects.

Congratulations on Levelling Up On Knockout Options!

Congratulations on making it to the end of this section. Knockout Options represent relatively complex financial products and having a solid foundation in them sets you on the path to a much deeper understanding of the FX options market.

You have earned yourself the choice of taking on the challenge of getting to the next level up or sitting back and enjoying the moment of your new achievement:

- Accept the challenge of levelling up on knockout option risk management considerations

- Enjoying the moment...

Knockout Option - Useful Background Knowledge

To better understand knockout options it is helpful to have a good grounding in fx option terminology, common fx option strategies, how options are funded and how these funding techniques are used when combining options.

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!